In an era defined by technological advancements, the recent announcement from Huawei regarding the Mate70 series has sent ripples through the global semiconductor landscape. The revelation that all chips within this latest series are fully domestically produced marks a significant milestone not just for Huawei but for China as a whole. It symbolizes a substantial step towards self-sufficiency in semiconductor production, especially in the realm of 7-nanometer chips.

This declaration sparked animated discussions across various online platforms, with many commentators interpreting it as a victory against the restrictions imposed by the United States on Chinese technology firms. The ability to produce chips at this advanced level hints at the burgeoning capabilities of China's semiconductor industry, fostering a sense of national pride and confidence among Chinese tech enthusiasts.

However, the sentiment across the Pacific was quite different. American officials and industry analysts were reportedly baffled by this announcement. For years, the U.S. has maintained a stronghold on critical semiconductor manufacturing technologies, especially in the high-end segment. The stringent export controls on essential equipment, like the EUV lithography machines, were designed to inhibit China's ability to develop advanced semiconductor technologies. The situation presents a paradox: how could Huawei, a targeted firm, manage to navigate these technological barriers successfully?

For a reality check, experts pointed out that while Huawei’s announcement is indeed impressive, challenges remain. Achieving the capability to manufacture 7-nanometer chips doesn't equate to matching the quality and yield of those produced by industry giants like Taiwan Semiconductor Manufacturing Company (TSMC) or Samsung. The absence of cutting-edge EUV lithography equipment presents a considerable roadblock. The United States appears to cling to the belief that as long as these machines remain inaccessible to China, the latter's ambitions in high-end chip manufacturing will be significantly hampered.

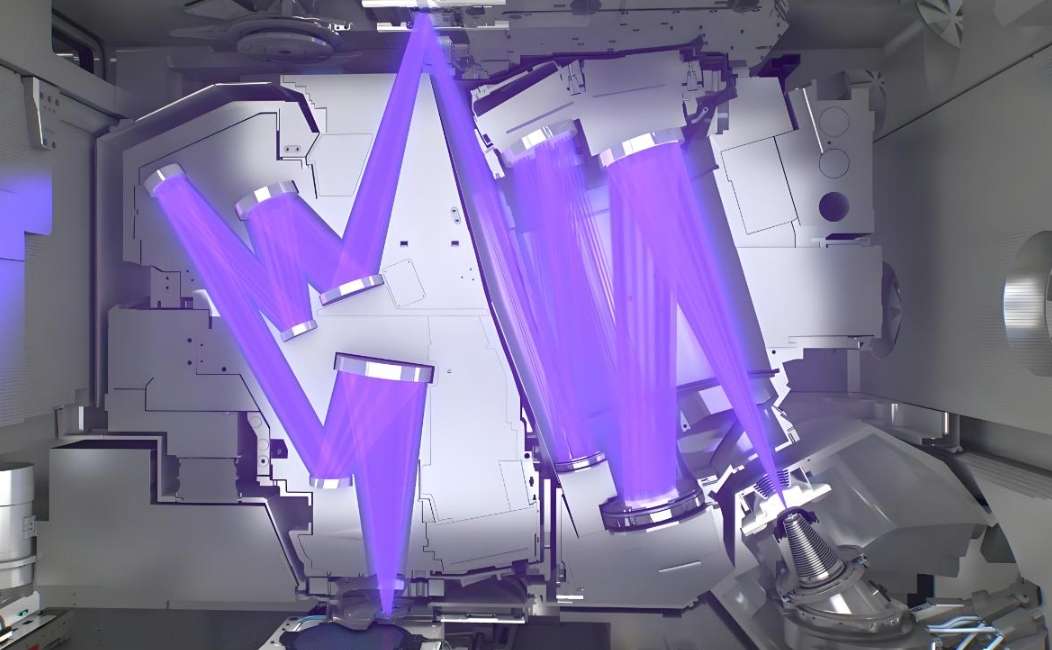

In a surprising turn of events, recent news from Harbin Institute of Technology has thrown a new twist into this narrative. Under the leadership of Professor Fan Jizhuang, a research team has reportedly succeeded in developing a 13.5-nanometer EUV light source using discharge plasma technology. This breakthrough is noteworthy not simply for its existence but for its promising capabilities, which are said to surpass those of the currently dominant EUV sources utilized by ASML.

What makes this achievement even more striking is the timeline of the team's progress. Back in 2022, they successfully developed a light source prototype. Over the subsequent two years, they refined their designs and passed various testing phases. This series of accomplishments indicates a robust foundation for the emergence of a viable domestic EUV light source, potentially revolutionizing China's lithography sector.

The intricacies of EUV lithography, however, cannot be ignored. Sophisticated equipment, including dual-stage platforms and high-quality lenses, play a crucial role. ASML operates with a vast network of over 5,000 global suppliers to assemble the required components for their machines. While China may still lag in some core technologies related to EUV lithography, it boasts a comprehensive industrial ecosystem capable of nurturing innovation. With patience and continuous effort, China’s advancements in this arena could one day rival those of established players.

The news from Harbin Institute of Technology has drawn accolades from international observers as well. Notably, Mr. Wang Guohui, founder of Singapore-based BISENG Asset Management, has hailed this development as a decisive milestone in China's journey toward self-reliance in semiconductor fabrication. Such recognition underscores the potential implications of this breakthrough not just for China but for the global tech landscape.

Predictions around the impact of domestically produced EUV lithography equipment are already rife. If China successfully develops and mass-produces these machines, it could signal a transformational shift in the competitive dynamics of the semiconductor marketplace. Companies such as SMIC may find themselves on equal footing with TSMC, and Huawei’s operational freedom could skyrocket, unleashing a wave of innovation.

The phrase, "the world is like chess, every move is new," resonates strongly in this context. China’s advancements in lithography technology pose a strategic challenge to American hegemony. Various tactics have been employed by the U.S. to constrain the growth of China's semiconductor industry, with the EUV lithography machines representing their last line of defense. As the walls of technological restriction begin to crumble, the U.S. may find itself grappling with its own dwindling influence.

ASML, the Dutch giant lashed by this uncertainty, must also tread carefully. Their past comments suggesting that providing blueprints would not enable China to replicate EUV machines are now being questioned as new evidence emerges of China’s rapid progress. The lesson from the shield machine case is clear—once a breakthrough occurs, costs may diminish and the entire industrial landscape could shift.

Looking ahead, should the Netherlands maintain its alignment with the U.S. in imposing restrictions on China’s semiconductor ambitions, ASML might not only forfeit the invaluable Chinese market but also find itself facing increased competitive pressures internationally. This evolving narrative opens up a broader discussion on global technological alliances, competitive strategy, and the future landscape of semiconductor production. As these developments unfold, stakeholders around the world will be keenly observing how the chess pieces move in this intricate game of technological supremacy.